If you’re self-employed and not sure of how this impacts your Medicare eligibility or wish to understand your obligations better, we’re here to help. Connect with us by calling and make positive you’re on the proper track together with your Medicare Advantages. Planning in your retirement requires awareness of your FICA contributions. A FICA tax calculator can simplify understanding what you are paying towards Social Safety and Medicare, which aren’t one and the identical.

Selecting A Payroll Companion To Simplify Compliance

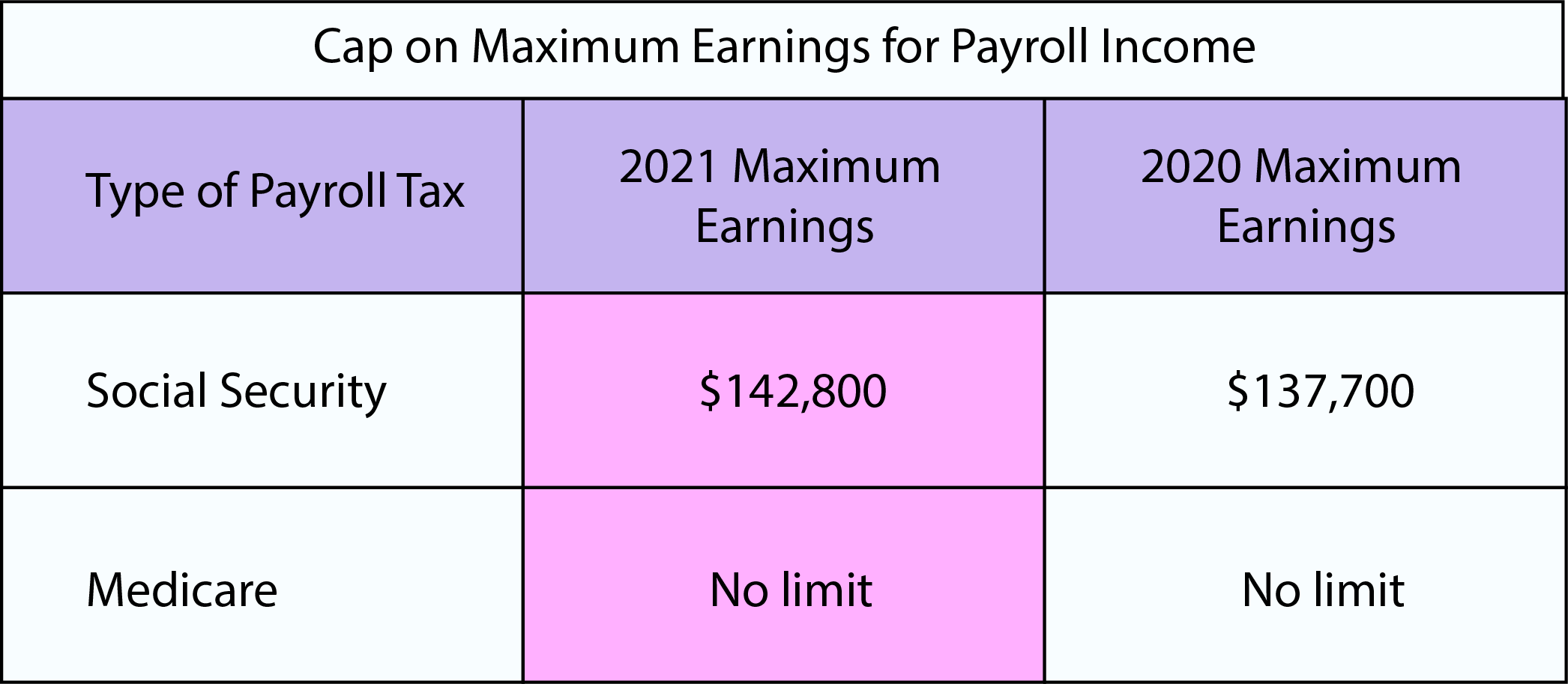

Tina’s work has appeared in a big selection of native and national media retailers. Failing to adjust to FICA tax rules can lead to serious penalties. Widespread errors include late deposits, late filings, underpayment, and worker misclassification. All coated wages, regardless of income level, are topic to Medicare tax. Wages above $176,100 are not topic to Social Safety tax, and no employer match is required beyond this limit for the rest of the calendar year. TheBestMedicarePlan.com does not gather personal health info, course of insurance coverage purposes, or offer personalised plan suggestions.

- Incapacity benefits, very similar to retirement earnings, have unique considerations concerning FICA tax.

- It Is more than only a deduction; it’s an investment in your monetary security.

- If you are self-employed and unsure of how this affects your Medicare eligibility or want to understand your obligations better, we’re here to assist.

- If you want to ensure your payroll reflects accurate deductions for FICA, Medicare, and Social Security taxes, you can create a paystub utilizing our automated device at PaystubsNow.

- Recognizing that “FICA” encompasses both programs clears up confusion about deductions from your revenue.

- Wages above $176,100 are not subject to Social Security tax, and no employer match is required beyond this restrict for the remainder of the calendar 12 months.

Medicare, then again, is the nationwide medical insurance program primarily for folks aged 65 years and older, but it additionally covers youthful adults with certain well being circumstances. In Distinction To Social Safety, there is not any revenue restrict on Medicare taxes – all earned revenue is topic to this tax. Nevertheless, the portion you pay as an employee for Medicare and Social Safety can have a long-term impression on your retirement and healthcare advantages. Many businesses depend on accounting services to manage payroll taxes effectively to avoid compliance issues. We additionally offer CFO providers for long-term monetary planning, money circulate management, and strategic development.

We imagine everyone ought to be in a position to https://www.intuit-payroll.org/ make monetary selections with confidence. For more insights on Medicare applications and customized care options, discover our articles about Medicare Kaiser Permanente and different specialised Medicare providers. Beneficiaries will receive a 2.5% improve in Social Safety and SSI payments, serving to maintain purchasing energy within the face of inflation. Calculate your take-home pay with our free hourly paycheck calculator for all 50 US states. They do not dial for you – they use an automated system that calls and navigates the IRS telephone tree, then waits on maintain in your place.

Who Pays Fica? Understanding Your Paycheck Contributions

Paying FICA taxes entitles you to incapacity and life insurance advantages as nicely. Provided you turn out to be disabled, you may be eligible for Social Security incapacity payments should you meet specific circumstances and have the required quantity of Social Security credits. If you die, your certified relations, corresponding to minor kids and a surviving partner who cares for young children or is 60 or older, could additionally be eligible for Social Security survivor funds. To qualify for a Social Security credit in 2022, you should earn a minimum of $1,510 and pay FICA taxes on that quantity.

That earnings will be taxable, along with some other income, primarily based in your tax bracket and the income tax fee tied to it. You’ll pay taxes now, however future withdrawals won’t rely towards your combined revenue. The OBBB deduction is anticipated to shield Social Safety advantages from federal taxes for about 88% of retirees, especially those in middle and decrease revenue brackets. The SSA additionally uses the variety of credits you’ve earned to find out your eligibility for retirement or disability benefits, Medicare and your family’s eligibility for survivor advantages. When you reach full retirement age, the test is more generous — you only forfeit $1 in advantages for each $3 in 2025 earnings above $62,160. As Quickly As you reach your FRA, there isn’t a limit on earnings for the remainder of the 12 months, and any withheld benefits are restored.

By now, you should have a stable grasp of what FICA taxes are and how they benefit you in the long run. They would possibly really feel like a deduction, however they are a elementary funding in your monetary future and the well-being of society. Knowing this gives you more management and a deeper understanding of your funds. The Social Security tax is a regressive tax, which signifies that an even bigger share of the entire earnings of lower-income workers is withheld than that of higher-income earners. So the place is this cash that is being taken out of your paycheck actually going? Read on for understanding fica basics, Medicare, and Social Safety tax.

Understanding these taxes helps you higher plan your finances and respect the advantages they fund. Use our calculator to see exactly how FICA taxes affect your take-home pay. FICA stands for the Federal Insurance Contributions Act, a regulation that mandates payroll taxes to fund Social Safety and Medicare.

FICA tax charges could change over time, with implications for both workers and employers. Notably, “FICA” and “Medicare” remain related but distinct terms—as Medicare is funded through FICA tax contributions. An enhance in FICA taxes means more funds for Medicare and Social Safety, strengthening the safety internet these applications present. It Is important to remain informed on such modifications as they could have an effect on your future benefits and retirement plans. If you are pondering the influence of a FICA tax improve on your Medicare eligibility or advantages, do not hesitate to achieve out. Employers are answerable for withholding the required FICA taxes from employees’ wages and making matching contributions.

High earners also owe a zero.9% Additional Medicare Tax on incomes above the set thresholds. For tax planning purposes, it is important to project annual earnings, think about the impression of wage base will increase, and plan for estimated taxes accordingly. High earners may see a bigger share of their earnings allotted to Medicare due to the lack of a wage cap on that tax. For prescription drug cost management under Medicare, don’t miss our in-depth evaluation of Medicare Part D. Income above this is not subject to Social Safety tax, however all wages are topic to Medicare tax.